For the past few years, there has been a lot of talk about how Blockchain, which is underpinned by the Distributed Ledger Technology (DLT) (1), is going to provide digital trust, between untrusting parties, (2) and is likely to be as transformational as the internet was in the 1970's. To date, the hype has not lived up to the reality. However, we do expect that in the future the Distributed Ledger Technology could impact most industries and businesses, potentially disintermediating many existing players in the market. Still, the mass adoption of the Blockchain technology could take a few years.

To understand the impact of the DLT, there is a need to assess the factors that will drive adoption, the main uses of the technology, the industries and countries that will be on the forefront of adoption, and the issues and challenges that still need to be addressed. Currently, most of the guidance for the use of the Blockchain technology is in the form of policies and procedures and not regulations. We expect that eventually several regulations will be put in place. The legal profession will play a critical role in supporting clients, to understand and effectively leverage the Blockchain for business use, while working closely with regulators and industry leaders to establish the regulations and standards for use of the technology. Eventually, after their clients have adopted the technology, the legal profession, could potentially use Blockchain to improve its own efficiency and effectiveness.

Take home

The Blockchain, underpinned by the Distributed Ledger Technology, has the potential to transform businesses globally

The legal industry will play a key role in the adoption of the DLT, educating all players in the legal ecosystem, helping corporates understand the legal and regulatory implications as they adopt Blockchain for their business and working with the regulators to establish standards.

Full article

Impact of Blockchain and the Distributed Ledger Technology on Global Markets

Distributed Ledger Technology: Factors for Adoption and Potential Uses

The DLT is a network of digital data, that data that is consistent, replicated, shared, and synchronized across multiple sites, countries, or institutions. It is Aa peer-to-peer platform, that platform that replicates and saves an identical copy of the ledger on each node in the network and updates itself independently, without the need of a central authority. Distributed ledgers may be private or public, and permissioned or less permission. Each transaction is essentially unalterable and can be changed only if 51% of all nodes agree.

For the successful adoption of the Distributed Ledger Technology, there are a few factors that need to be in place, (3) such as:

- Digital assets that can be stored and transferred in a virtual world;

- A market with multiple players and a high volume of transactions;

- A significant market pain point that needs to be addressed;

- Low trust in the existing market infrastructure; and

- The benefits of adoption outweighing the costs of implementation.

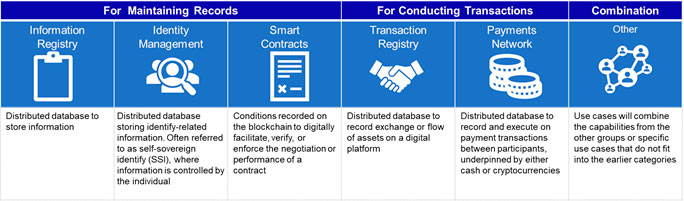

The main uses for the DLT can be divided into three broad categories: maintaining records, conducting transactions and a combination of the two. These categories are further divided into six areas of focus:

Potential Uses for the Blockchain

Distributed Ledger Technology: Industries and Countries leading the use of the technology

To date, the most successful use of the DLT has been in cryptocurrencies, (4) of which Bitcoin is the most well-known. The introduction of crypto currencies was an attempt to intermediate the $1.9 trillion payments industry that is expected to grow to $3 trillion within the next 5 years. (5, 6, 7, 8) Bitcoin's popularity helped demonstrate Blockchain's application in finance, but entrepreneurs have come to believe that Blockchain could transform many more industries. In 2019, businesses spent ~$2.9B on the Blockchain technology, up almost 90% from 2018. Industries across the board are starting to see Blockchain applications.

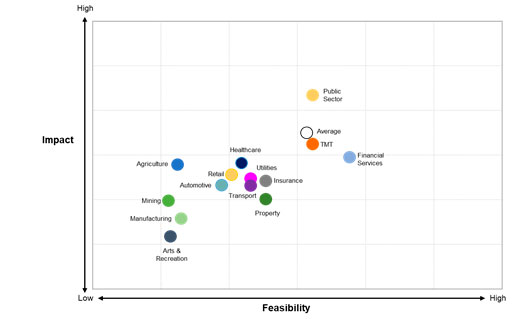

Blockchain Opportunities by Industry

Source: Blockchain beyond the hype: What is the strategic business value, McKinsey Digital, 2018.

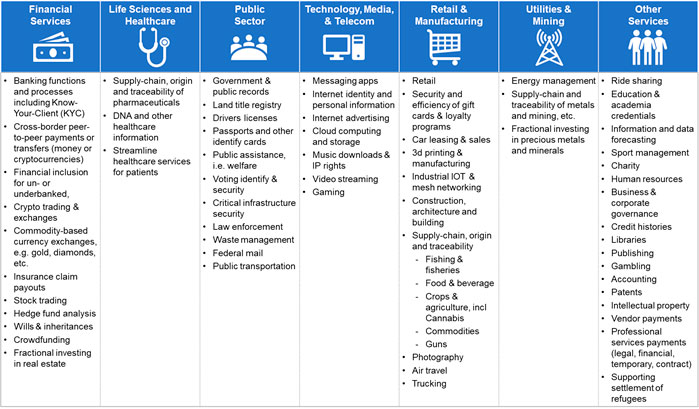

Blockchain Applications, by Industry

Source: Banking Is Only Thethe Beginning: 55 Big Industries Blockchain Could Transform, CBS Insights, Jun 11, 2019

The industries that have been on the frontline of experimentation with the DLT are: Public Sector, Financial Services and Healthcare. Some other industries that are experimenting with the Blockchain and the DLT are real estate for title registry, music industry for digital rights management, and the food and beverage industry for supply chain management and food safety and origin. Our expectation is that in the near term, the Public Sector, including governments and agencies, will lead the way in implementing the Blockchain to solve some of the major challenges they are facing and use it to serve their citizens most effectively.

The industries that are more likely to drive the adoption of Blockchain solutions are public sector, financial services, and healthcare.

Many countries are trying to become the undisputed capital of Blockchain innovation leveraging the best Blockchain experts and tech-savvy minds. A few countries that have taken the lead in the adoption of Distributed Ledger Technology are Australia, China, Estonia, Japan, Malta, Russia, Switzerland, United Arab Emirates (U.A.E.), U.S.A., and the U.K.

Top 10 Countries Leadingleading the use of Blockchain

Source: Top 10 countries, leading Blockchain technology in the world, Blockchain Council, Apr 10, 2019

While many of the leading countries are focusing on the use of Blockchain for cryptocurrencies, others are using the technology to establish a more seamless economy, such as:

U.K. government has been embracing Blockchain to improve issues of identity theft and slow financial services, as a regulatory tool for regulating meat data, archiving documents on the Blockchain and potentially for voting and healthcare systems.

UAE is planning to move government-related data and documentation on the Blockchain by 2020.

Estonia has digitized its public sector services using Blockchain technology.

U.K. government has been embracing Blockchain to improve issues of identity theft and slow financial services, as a regulatory tool for regulating meat data, archiving documents on the Blockchain and potentially for voting and healthcare systems.

Singapore is using Blockchain in the technological and financial sector, for cross-border payments, smart contracts in insurance and for building a secure healthcare data system.

UAE is planning to move government-related data and documentation on the Blockchain by 2020.

Switzerland in 2016, became the first city in the world to accept Bitcoin payments for tax purposes. In 2017, it announced the launching of its decentralized Ethereum-based digital ID system and in 2018, it successfully completed the first testing of the local Blockchain-based voting system.

Switzerland, in 2016, became the first city in the world to accept Bitcoin payments for tax purposes

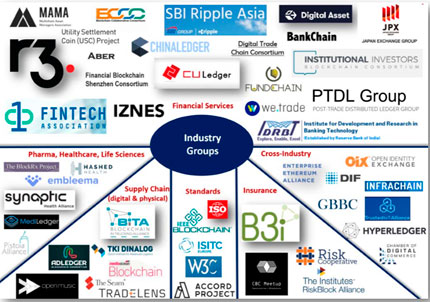

Blockchain and Consortia

The participation by enterprises, technology providers, regulators, and governments is key to the development of the Blockchain and helps increase adoption of the technology.(9) This is the most important aspect of the DLT, and also it biggest challenge, as this requires a network of players in the ecosystem, to work together to solve a common problem for the "greater good", adhering to common industry, regulatory, and security and privacy standards, without a central authority to monitor the network. This has driven the need for Blockchain consortiums, which will initially be industry-focused and will solve for industry specific pain points. To date, most industry consortiums have had modest success.

Leading Industry Blockchain Consortiums

Some leading Blockchain consortia are (10):

Hyperledger – It is one of the best open-source platforms for enterprises and offers tons of solutions It is one of the best open-source platforms for enterprises, offers tons of solutions, and is focused on providing technological support. In addition, Hyperledger has many projects, in addition to, tools, platforms, and libraries.

Enterprise Ethereum Alliance – The alliance was founded by Vitalk Buterin, and was originally a public Blockchain, but now includes an enterprise-grade Blockchain that provides transaction privacy in addition to other facilities. They have 250+ members collaborating to innovate businesses.

R3 – Historically this was set up to focus on financial services niches and had 200+ members, including most of the leading financial institutions. At present, the consortium is dual focused with an open-source version of their platform Corda, and a commercial one for enterprise. Both platforms are compatible with each other. R3 is now trying to include other use cases beyond the financial services industry.

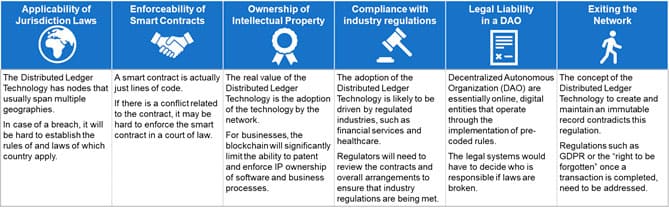

Blockchain-related Legal and Regulatory Issues

Blockchain technology's regulatory landscape is fluid at present. Regulators are finding it difficult to establish clear rules because Blockchain is not a homogenous digital asset class and may have characteristics of a security, commodity, currency unit, or a combination thereof, and can even change status over time from a security to a non-security. As a result of these ambiguities, the technology doesn't fit neatly into any existing regulatory frameworks, and regulatory developments. The growing enforcement initiatives in the near future,future will likely be uncoordinated and piecemeal. (10)

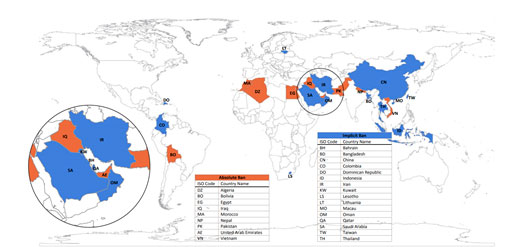

The most common uses of the Distributed Ledger Technology, to date, are for cryptocurrencies and for Initial Coin Offerings (ICOs) or Security Token Offerings (STO's). In the past few years, cryptocurrencies have become ubiquitous, prompting more national and regional authorities to grapple with their regulation. Most governments are issuing warnings to investors about the difference between actual currencies and cryptocurrencies, i.e. cryptocurrencies lack government backing, have high volatility, have unregulated transactions, and investors lack legal recourse when there is a loss. In addition, cryptocurrencies create opportunities for illegal activities, such as money laundering and terrorism. As a result, some countries have even banned the use of cryptocurrencies.

Legal Status of Cryptocurrencies

Source: Regulation of Cryptocurrency AAround the World, The Law Library of Congress, June 2018

Sales of Blockchain-based "Initial Coin Offerings" or "Security Token Offerings" that may be exchanged for products, services or fiat currency have become a powerful and seemingly efficient new means for Blockchain-related businesses to raise capital, bypassing more traditional funding. However, ease of use of ICOs and STOs has led many sponsors to unintentionally engage in activities that may violate securities regulations in various jurisdictions. Securities law compliance is particularly challenging in the context of Blockchain-based instruments because they are decentralized, liquid and transferable across regulatory borders virtually with the click of a button.

Blockchain technology will also continue to be treated differently in different jurisdictions and even among various domestic agencies.

The regulations (11) in place for cryptocurrencies and coin/token offerings, in some of key countries are:

United States – Cryptocurrencies has been the focus of much attention by both the federal and state governments, including the Securities Exchange Commission (SEC), Commodities and Trading Future Commission (CFTC), Department of Treasury, Internal Revenue Services (IRS) and Financial Crimes Enforcement Network (FinCen).(12) While there has been much significant engagement by these agencies, little formal rule making has occurred. Regarding tokens, the SEC has not issued any official guidance that clearly distinguishes tokens that are securities from those that are not, and it is unlikely to do so in the near future. However, various informal, non-binding statements by the Chairman of the SEC and members of the SEC's staff indicate they recognize there is a continuum spanning from security tokens to utility tokens, and that tokens may move along this continuum during their lifecycle.

United Kingdom - The United Kingdom does not have any laws that specifically regulate cryptocurrencies. The governor of the Bank of England has stated that regulation of cryptocurrencies is necessary: Unlike the U.S. law, neither English nor European law contains a generalized test to define a security. Accordingly, ICO and STO sponsors must look to the definitions under the UK and EU rules. These rules contain definitions of many types of instruments that would constitute a security and prospective ICO and STO issuers should consider each of these to assess whether the token being issued may be a security.

Australia – The Australian Tax Office (ATO) has published a guidance document on the tax treatment of cryptocurrencies. According to the guidance, transacting with cryptocurrencies is "akin to a barter", with similar tax consequences. Cryptocurrencies may be considered assets for capital gains tax purposes. For business transactions, the dollar value of Bitcoins received for goods and services must be recorded as part of ordinary income, and all relevant taxes will be applicable. The Australian Securities and Investments Commission (ASIC) takes a relatively broad approach to regulating ICOs and STOs. ASIC has emphasized that the structure and operation of an ICO determines its legal status.

Singapore - The Monetary Authority of Singapore (MAS) does not regulate cryptocurrencies however, tokens offered in an ICO or STO, that are considered an offer of shares or units in a collective investment scheme under the Securities and Futures Act (SFA) will be regulated. In addition, MAS would regulate activities involving the use of cryptocurrencies that fall under MAS's regulatory ambit, such as money laundering and terrorism financing.

China - Chinese regulators are not recognizing cryptocurrencies such as Bitcoin as a tool for retail payments like paper bills, coins, or credit cards. The banking system is not accepting any existing virtual currencies or providing relevant services. The People's Bank of China (PBOC) explicitly banned the use of ICOs. Additionally, the PBOC made an official order to banks to stop opening accounts for virtual fundraisers and will further increase regulatory pressure on cryptocurrency trading by targeting online platforms which platforms, which offer exchange-like services and ICOs.

Japan - In Japan, cryptocurrency exchange businesses are regulated. Cryptocurrency is limited to property values that are stored electronically on electronic devices; currency and currency-denominated assets are excluded. Under the Payment Services Act, only business operators registered with a competent local Finance Bureau can operate cryptocurrency exchange businesses. The Japanese Financial Services Agency (FSA) released proposed guidelines to legalize and regulate ICOs, including providing regulatory definitions and approvals. The guidelines do not identify ICOs as financial securities. The FSA highlighted that businesses launching an ICO may fall within the Payment Services Act or the Financial Instruments and Exchange Act. In doing so, cryptocurrency exchanges providers must be registered with each Local Finance Bureau.

In summary, many legal and regulatory issues regarding the Blockchain still need to be addressed.

Blockchain-related Legal and Regulatory Issues to be Addressed

In addition to the legal issues, some Security & Privacy and Anti-Money Laundering (AML) and KYC (Know your Client) issues will need to be addressed.

Security issues – The benefit of the decentralized nature of the Blockchain is supposed to be that it is hard to hack. However, to date, there have already been multiple attacks on various crypto exchanges, with millions of dollars' worth of value being lost. For any commercial uses, case of the Blockchain to be successful will require the network to be very secure.

Privacy – On the Blockchain, all the transactions, even if they are encrypted, are open to the public. Many players may not be comfortable disclosing their information to all players, specially, if it relates to financial, legal or health issues.

Anti-Money Laundering (AML) and Know Your Client (KYC) issues – The Blockchain provides anonymity for entities and their transactions. However, for use in industries such as financial services, the Blockchain will need to meet both KYC and AML requirements, to adhere to the institution's compliance program while satisfying any legal and regulatory requirements.

Role of the Legal Industry in the Adoption of Blockchain

On the Blockchain, all the transactions, even if they are encrypted, are open to the public.

For the "practice of law"law", the legal industry (13) will play a vital role in the adoption of the technology by:

- Training all the players in the legal ecosystem on the use and legal implications of the technology;

- Guiding corporate clients as they run DLT use-cases, then implement the technology to run their business;

- Working with regulators to establish legal and regulatory standards for the use of the technology;

- Being a critical part of relevant industry and legal consortiums to develop common industry standards; and

- Collaborating with other legal service providers to leverage DLT to serve existing clients.

For the "business of law", the legal industry will be a "follower" in the adoption of the DLT and move to it after its clients' have adopted the technology. Once the use of the DLT becomes ubiquitous for its customers, the legal industry can use of the technology for improving its efficiency and effectiveness in serving its customers in the following areas: (14,15)

- Execution of legal services, such as, dispute resolution and arbitration, development and execution of smart contracts; filing corporate returns, etc.;

- Verification and authentication of legal business operations for customers, i.e. document management, billing and expense management, etc.;

- Performing of legal tasks such as maintaining chain of documents during custody cases, M&A transactions, recording and maintaining historical case-related information, and notarizing documents;

- Providing "Access to Justice" to those currently livings outside the protection of the law leveraging digital platforms, for providing legal advice at lower costs.

Conclusion

In conclusion, we believe that the Blockchain, underpinned by the Distributed Ledger Technology, has the potential to transform businesses globally. Given the current state of the technology and the factors for the successful adoption of Blockchain, the widespread use of the technology for commercial use is still a few years away.

The legal industry will play a key role in the adoption of the DLT, educating all players in the legal ecosystem, helping corporates understand the legal and regulatory implications as they adopt Blockchain for their business and working with the regulators to establish standards. They will also be critical in establishing common industry standards for the legal profession and collaborating with other legal service providers to serve clients more efficiently and effectively. However, the legal industry will not be an early adopter in the use of the DLT for its own use and will only adopt it after its customers have started using it to run their business.

2. “Bitcoin: A Peer-to-Peer Electronic Cash System”, Satoshi Nakamoto, 2008

6. As of June 20, 2019, the daily trading volume of cryptocurrencies is $52.5 billion.

7. Aug 7, 2019

8. Nov 2017

9. https://www.cnbc.com/2018/10/01/five-crucial-challenges-for-blockchain-to-overcome-deloitte.html

10. Blockchain Consortium: Top 20 Consortia You Should Check Out, Nov 16, 2019

11. Blockchain Basics: Global Regulations,

- France

- Germany

- Global

- Malta

- Switzerland

- United Kingdom

- USA November 28 2019.

12. https://www.globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/usa

13. Blockchain and Cryptocurrency regulation, 2019, Global Legal Insights.

14. https://www.loc.gov/law/help/cryptocurrency/world-survey.php#compsum

15. An Industry in Transition: Legal Services Market of the Future, May 2018

16. https://www.techradar.com/news/7-ways-blockchain-will-change-the-legal-industry-forever

17. https://www.disruptordaily.com/blockchain-use-cases-legal/

Comments

Related links

Main menu