What if the easiest way to reduce outside counsel costs is simple: Switching to cheaper firms?

---

This is part two of Nathan Cemenska’s series on legal pricing and law department spend. Read part one: Do large corporate legal departments get better rates? Not always.

Most law department sourcing patterns probably reflect no holistic design. Nobody ever sat down and said, let’s hit the reset button, forget all our existing provider relationships, and start over with a blank piece of paper. Instead, the provider mix emerged organically from the primordial ooze, the time just a decade or two ago when legal was viewed as a “black box” that couldn’t be measured, let alone managed. Given this lack of transparency, it wouldn’t be surprising if the relationships developed during that time had more to do with who knows who rather than any kind of rational, exhaustive search for cost-appropriate expertise. And regardless of the changes brought by the advent of legal ops in the last decade and a half, the law firm relationships they are trying to improve—and the tone of those relationships—were established back when running your law department like a business wasn’t even a thing.

Legal ops works hard to control costs. They create departmental, practice-group, and matter-level budgets; negotiate, monitor, and enforce AFAs; scrutinize law firm invoices; and dicker over annual requests for hourly rate increases. They issue RFPs and perform reverse auctions. They create preferred provider panels, score counsel on various dimensions like quality, “responsiveness,” and results, and spend dozens of hours conducting quarterly business reviews about how to improve the business aspect of their law firm partnerships.

I would never dismiss any of those efforts, which most experts deem to result in significant improvement in cost control (see the 2019 Altman Weil CLO Survey, p. 29). However, couldn’t you just hire cheaper firms? The data suggests that many organizations have room to do just that, without necessarily impairing the quality of legal work.

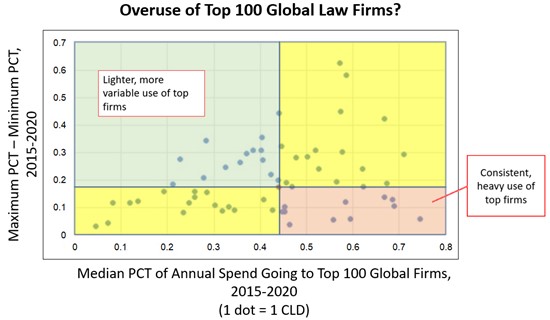

The below visualization divides CLDs into four types: Consistent heavy use of top firms (the red area), heavy but highly variable use of those firms, lighter but highly variable use, and consistently low use of those firms. This is actual spend data from a representative sample of clients in Wolters Kluwer’s ELM Solutions’ LegalVIEW® database, the largest body of legal performance data in the world, where leading CLDs and insurance claims departments agree to share data in an anonymized way to support research and help improve the legal industry.

The “median” CLD (the red dot in the middle) sends 43.9% of its spend to the top 100 global law firms. That might sound high, but many CLDs go much higher (see the x-axis of the below illustration). One law department, for example, sent a median of 74.6% of all spend to those top law firms over a six-year period (2015 to 2020).

The data also suggests that not only does a high percentage of work get sent to the largest firms but that that percentage doesn’t tend to vary much YoY in many CLDs (see the y-axis, above, which shows the maximum percentage minus the minimum percentage). The utilization of top firms by the CLD we just mentioned, for instance, varied only about 6% over a six-year period, ranging from 69.8% of spend in 2015 to 75.8% of spend in 2018. Either that CLD has a very consistent level of “bet the company” work, or it is sending a lot of ordinary work to “bet the company” firms, even though that level of expertise isn’t necessary.

If I were a CFO, that would trouble me. Can the law department show that the risk and complexity of the legal problems facing the organization required this exceptionally consistent, heavy utilization of the most expensive providers? Can the law department show that they have a process for evaluating legal matters for risk and complexity and ensuring they get sourced in a way that reflects those evaluations? I do not know the answer for this particular law department, but in general, I can absolutely say, based on talks with dozens and dozens of thought leaders in the legal industry, that the average CLD is years away from getting around to scoring individual legal matters for risk and complexity and is therefore incapable of producing data showing its legal matters are being sourced to the appropriate provider tier. In fact, the idea of risk-scoring might even be deemed threatening to in-house attorneys who want law firm relationships to be driven by attorney judgment rather than data.

The elephant in the room is this: No matter how aggressive your budgeting, AFAs, panels, and other measures, when you send all your work to megafirms, it isn’t going to be affordable. Many don’t want to confront that elephant, because that would disturb existing relationships and upset a lot of people who are quite comfortable, despite all their rhetoric, with the way that things have always been done. But I have spoken to CLDs that are doing it, and they are saving way more than the best-negotiated AFA.

Related links

Main menu